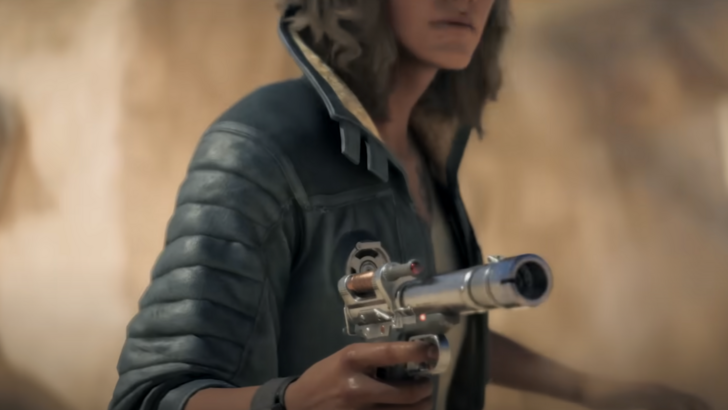

Star Wars Outlaws' Sales Predicted to Fall Off by Industry Analyst

Ubisoft's Star Wars Outlaws Underperforms, Impacting Share Price

Ubisoft's highly anticipated Star Wars Outlaws, intended as a financial turnaround point, has reportedly underperformed sales expectations, causing a dip in the company's share price. Despite positive critical reception, sales have been described as sluggish.

Share Price Decline

Following the game's August 30th release, Ubisoft's share price fell for two consecutive days, dropping 5.1% on Monday, September 3rd, and a further 2.4% by Tuesday morning. This marks the lowest point since 2015, adding to a year-to-date decline exceeding 30%.

Sales Projections Lowered

J.P. Morgan analyst Daniel Kerven revised his sales projections for Star Wars Outlaws downward from 7.5 million units to 5.5 million units by March 2025, citing the game's struggle to meet initial expectations.

Ubisoft's Q1 2024-25 report highlighted Star Wars Outlaws and Assassin's Creed Shadows (AC Shadows) as key "value drivers" for the company's future financial performance. While the report noted a 15% increase in session days and a 7% year-on-year rise in monthly active users (MAUs) to 38 million, driven largely by Games-as-a-Service titles, the underperformance of Star Wars Outlaws casts a shadow on these positive trends.

Mixed Player Reception

The discrepancy between critical acclaim and player reception is notable. While critics generally praised the game, Metacritic's user score stands at a mere 4.5 out of 10. Conversely, Game8 awarded Star Wars Outlaws a 90/100 rating, deeming it an exceptional title. For a more detailed perspective, consult our review (link omitted). The divergence in user reviews highlights a potential disconnect between expectations and the actual gameplay experience.

-

The Sony DualSense stands out as the premier PS5 controller, thanks to its innovative features, comfortable grip, and ergonomic design that enhance your PlayStation 5 gaming experience. Connecting it to a high-performance gaming PC might seem challenAuthor : Aria Feb 23,2026

-

Figment 2: Creed Valley delivers a surreal action-adventure experience for iOS players. Step into a world where the human mind comes alive - where melodies become landscapes and battles transform into musical performances. You'll play as Dusty, the vAuthor : Owen Feb 21,2026

-

Lust Doll Plus (r66.1)Download

Lust Doll Plus (r66.1)Download -

Southern PokerDownload

Southern PokerDownload -

Fruit Summer Slots MachineDownload

Fruit Summer Slots MachineDownload -

Tarot Offline - Card GameDownload

Tarot Offline - Card GameDownload -

Virtuelles Casino - Craps Spiel OnlineDownload

Virtuelles Casino - Craps Spiel OnlineDownload -

BrazilyaDownload

BrazilyaDownload -

Battle Angel Moe moe arena-Download

Battle Angel Moe moe arena-Download -

Sandy BayDownload

Sandy BayDownload -

Spell CastersDownload

Spell CastersDownload -

Brain Puzzle - IQ Test GamesDownload

Brain Puzzle - IQ Test GamesDownload

- Black Ops 6 Zombies: How To Configure The Summoning Circle Rings on Citadelle Des Morts

- Roblox: Latest DOORS Codes Released!

- Harvest Moon: Lost Valley DLC and Preorder Details Revealed

- Silent Hill 2 Remake Coming to Xbox and Switch in 2025

- Roblox: Blox Fruits Codes (January 2025)

- Roblox: Freeze for UGC Codes (January 2025)

![Taffy Tales [v1.07.3a]](https://imgs.ehr99.com/uploads/32/1719554710667e529623764.jpg)